TATA AIG student travel insurance for UK

TATA AIG student travel insurance for UK

Indian students who want to extend or renew click hear and fill the form TATA AIG international travel insurance renewal request form online and we will try to get an approval for you.

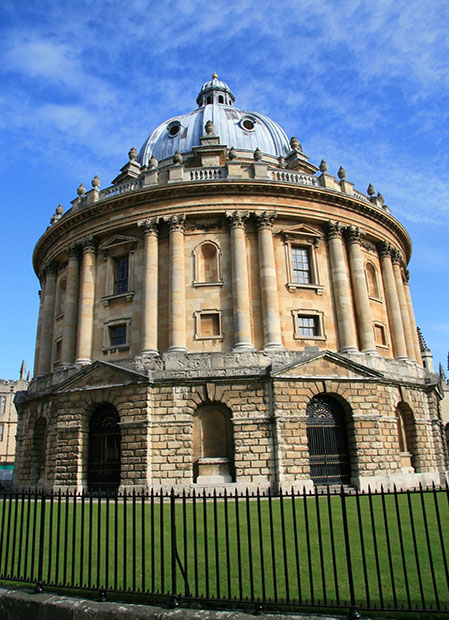

Given the colonial legacy and common cultural roots, Indian students find studying in the UK very attractive. The UK attracts a lot of international students from Europe and elsewhere, so studying in an UK university gives Indian students a very broad cultural perspective.

UK educational institutions use a variety of teaching and assessment methods to encourage independence, as well as mastery of the subject.

Please read through TATA AIG student insurance brochure for the benefits covered by the plan and its policy wordings which explains the terms and conditions. You can also complete an online TATA AIG Travelguard proposal form. You can also get the best travel insurance quotes using the TATA AIG Student guard premium chart

A full refund of the premium if rejected by the university.

Will help complete the university waiver form if required.

Special approval possible for students already outside India

TATA AIG student insurance reimburses the semester fee if the student is not able to complete the studies due to a medical emergency.

If the sponsor of the students education is fatally injured or left permanently disabled, the TATA AIG student insurance will help cover the tuition fees for the remainder of the course.

When you buy the TATA AIG student travel insurance, your pay in Indian Rupees, but are covered in US Dollars. This makes the TATA AIG student medical insurance very affordable when compared to international student insurance options.

The cost of insurance for Indian students studying abroad is significantly lower for Indian insurance plans compared to international plans, as the premium is paid in Indian Rupees. The cost of TATA AIG student insurance for students going to UK price ranges between ₹1,241 to ₹1,886 per month depending on the age, type of plan and policy maximum coverage.

| For students going to UK | ||

|---|---|---|

| Plan Name | Policy maximum | Cost per month |

| Student Guard Plan A | $50,000 | ₹1,241 |

| Student Guard Plan B | $1,00,000 | ₹1,382 |

| Student Guard Ultimate | $2,50,000 | ₹1,615 |

| Student Guard Ultimate Plus | $5,00,000 | ₹1,786 |

| Student Supreme | $5,00,000 | ₹1,886 |

Indian students preparing to study in the UK should ensure that they have proper student health insurance. Health care is expensive, and being unisured in the UK is very risky. It is vital as student insurance will help you financially, in case of medical emergencies. Even if you think you don’t need a health insurance while going abroad for study, your university often insists on student insurance. Health insurance is usually a part of many visa conditions that an international student must comply with. When compared to uk insurance plan, it has additional coverage in that along with the regular student insurance it also has cover for Study Interruption, Sponsor Protection and Compassionate visit. All of these are designed specifically to the needs of Indian students outside India.

The free-look period is a 15-day buffer period during which students can review the policy documents and choose to cancel the policy without having to pay a cancellation fee. This is very useful if one is not sure of the University will accept the student insurance.

Yes, there is an age limit to be eligible to buy the TATA AIG student travel insurance. The student must be between the ages of 16 and 35 to satisfy eligibility.

Yes, If the student requires a dental surgery to treat acute pain from a natural tooth, the student medical insurance will help take care of the cost.

No, the TATA AIG student travel insurance will not cover any costs associated with treatment of a pre-existing ailment unless it is a life-threatening situation.

In circumstances where the student is hospitalised for over a month or cannot continue education due to a covered illness or injury, the student travel insurance will reimburse the student for any tuition fees that are already paid to the educational institution.

Student travel insurance is strongly recommended even if the students is traveling to a country where student travel insurance is not mandatory. Given the benefits of having student travel insurance, it is strongly advised to buy TATA AIG UK insurance for international students.

International students are not required to produce proof of student insurance for their F1 visa and there is no US government insurance requirements for studying in the US. However, very often US universities insist of student insurance requirements. It is however strongly advised to buy TATA AIG UK student insurance given the benefits of good student travel insurance.

Even if not mandated by any authorities, good medical travel insurance plan can protect the student while outside India. Student medical insurance takes care of hospital related costs, medicine expenses and costs related to an emergency surgery

In the U.S., access to low-cost or public health care is very limited, and international students typically are not eligible for most programs. Experts say students should contact universities about their specific policies, which can vary widely.

Download TATA AIG student travel Guard brochure online.

Students already outside India without insurance? We can try to get special approval to buy TATA AIG travel insurance online.

Download TATA AIG student travel Guard wordings online.

In case of Claim or reimbursement of treatment expenses, notify TATA AIG toll free and helpline.

Get all the answers to the most frequently asked questions (FAQs) regarding student travel medical insurance offered by TATA AIG.

Students can renew their existing policy online before the exipry date at any time.

Useful discussions and forum entries for best international TATA AIG international student insurance.

List of some of the Universities whose students have purchased TATA AIG student health insurance in the past.

Compare TATA AIG student health insurance plans.

Mr. Jaideep Deorukhkar, Head Travel Services at Tata AIG says "NRIOL has been one of our key partners in India for the past 16 years and has been pivotal in providing Tata AIG customers an opportunity to purchase their TATA AIG travel insurance online".